Future of Motor Insurance Industry: Bright or Bleak?

As per Technavio’s research, the global motor vehicle insurance market will experience a steady growth at a CAGR of about 6% in the coming years. Motors, being motivation for people nowadays, have given birth to a new industry called the Auto Insurance Industry. The burgeoning sale of vehicles is the reason for the growth of this two-wheeler insurance industry.

Delving a little deeper, we can see that the increase in the per capita income of the upcoming economies has triggered the sales of motor vehicles. One of the major drivers for this growth is that the government of India has made motor insurance mandatory for each vehicle, including when you purchase one.

Another major factor responsible for the industry growth is the innovation in the sector, which does not let the market in stagnation, as it allures people to buy vehicles.

Along with this, there are several facilities, such as riders with zero depreciation cover for motor insurance, offered by leading insurance providers in the country. This growth was not only an instantaneous growth, as this will continue to be the same until 2020, and this will have a positive impact on insurance sales and will focus on the emerging market trends.

Auto insurance gross written premiums (GWP) experienced a global growth rate of US$669.7 billion. As per Finaccord, a U.K.-based market research company having expertise in financial services offers, the growth rate to be the same in most of the countries till 2018.

Finaccord also stated that the global auto market saw a growth rate of 2.9% in real terms around US$548.0 in the year 2010 and 2014. Moreover, the compound annual growth rate was around 5.1%.

Growth rate in emerging economies:

It is a well-known fact that the non-life insurance sector grows according to economic growth. This economic growth is the reason why two wheelers insurance industry is booming. The surprising fact is that this is also applicable to growing economies, such as India, China, Thailand, Indonesia, Korea, Vietnam, and others.

The growth rate has increased in tandem with the nominal rate (real + inflation) of economic growth. In past one decade, a growth in CAGR (i.e. Compound Annual Growth Rate) of 17% was experienced in non-life gross premiums, which was a bit more as compared to the nominal GDP growth (wherein the GDP growth during this time was 7.7%).

Talking about years 2011 and 2013, the average growth rate was noted to be 22%, and since then, the insurance sector has been seeing a comparatively modest growth. The major factor that accounts for this slowdown can be the staggering economic growth in these years.

Moreover, it is seen that the motor insurance sector has grown to be the biggest sector in the General Insurance category, as this sector contributes 46% of the total GDP to the non-life sector in the fiscal year 2014. This growth was the slowest in four fiscal years; 25% of CAGR during FY11-13.

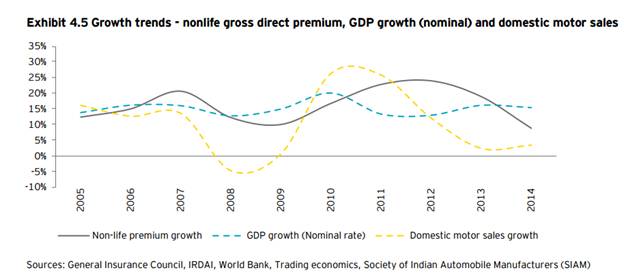

The reason being for the sloppy growth of the premium paid is slow growth in the section of passenger vehicles, where the growth in sales was 4% in the domestic as well as in exports. The graph shown below depicts a correlation between non-life premiums and the GDP growth with annual motor sales.

We can see that motor sales offer quite an instant impact on premiums of the non-life insurance sector; there is a difference between GDP growth/decline and general premiums.

As per the estimate of the World Bank, GDP of India is likely to grow up at a rate similar to the growth of 7.4 % in the FY15, which is greater than the growth rate of 6.2% of the fiscal year 2012 and 2014.

Things yet to work on!

Without the slightest pinch of doubt, we are well aware of the fact that motor insurance has tremendously improved, but there are certain roadblocks due to which we have been experiencing certain losses in this sector.

The condition of receiving claims remains drastically bad and this is even after the double-digit growth in last eight years. This is the reason why the sector has been making major losses in its core operations, wherein the major source of profit is income from the investment from the funds of the policyholder.

In 2014, the total claims throughout the industry have increased by 15%, which is from INR 396 billion to 457 billion, and therefore, the underwritten profits do not exist since 2011.

There are several segments in which motor insurance the largest and fastest growing segment with a huge claim settlement ratio of 80%.

There are several factors that account for the soaring cost of claims, such as liability losses from third-party sellers, constant price competition, and growing fraudulent primarily in these two segments.

Liability pool in third-party insurance

Let’s take an example of the motor insurance sector in India, where the liability pool for the third party was the major cause in the non-life sector till 2011. In order to regulate this, IMTPIP (i.e. Indian Motor Third Party Insurance Pool) was set up as a system where all third-party liability claims for all vehicles are collected into a pool. This organization lingered around for about five years, i.e. from 2007 to 2011, which led to heavy losses. The claims ratio for motor rose to 103% in the fiscal year 2011.

Further in 2012, IMTPIP was dismantled, and then Declined Risk Pool was introduced. It took only risks that were related to third-party liability that they were not willing to have on their books, which was administered by General Insurance Corporation.

This advancement came as a relief for non-life insurers, as it freed up the pricing model and offered insurers the leverage to set up the cost of the vehicles depending on the claims. Due to this, there has been a considerable increase in the ratio since fiscal Year 2011.

Managing the losses incurred due to motor insurance is still quite a daunting task, as the regulator has made it compulsory for insurers to have a minimum percentage of underwritten third-party business. Along with this, there is very less increase in the third-party tariff as compared to what was expected, and this is one of the biggest challenges for non-life insurers.

Tough competition when price is the only differentiator

There was an increase in the number of insurance policies in the non-life sector, which was from 15 to 28. Due to this, price wars was started in order to gain a fair share of the market. The restrictions on the premium pricing of the chief non-life segment, which is third-party motor liability, heavy losses were incurred by the insurers.

One of the major factors why customers depend on the price when it comes to general insurance is because the insurance providers are unable to make a difference between features of the products and the customer's awareness about the product.

There are several cases where the insurers have to deal with fraud-related to claims in which the insurers have been struggling to control the costs that increases due to fraud committed while paying the claims.

The cost increases, as the insurers have to go through investigation as well as through litigation process. Along with this, they struggle with a decline in the contentment levels offered to the customer since this causes a delay in paying claims to genuine customers.

There are times when insurers often find it to settle the fraudulent claim rather than going for an investigating process. Some of the common types of frauds are:

• Altering the date of the mishap

• Overstating the repair bills

• Not revealing the diseases that existed before the medical bills

• Presenting fake information about the purpose of hospitalization

• Presenting not real hospital bills and making unreasonable claims

• Presenting false path lab reports

Wrapping up!

No one can oppose the fact that the motor insurance industry is growing, which certainly is great news, as we now have ample of policies to choose from. However, there are certain roadblocks that are hampering its growth. Here, as consumers, we need to realize the fact that the growth in this sector is somewhere for those who uses roadways, in short, for everyone.

Comments

There are 0 comments on this post