Yahoo Keeps On Falling, Reports Loss of $440 Million

Yahoo's latest earnings report leaves no doubt the internet company is stuck in a downward spiral.

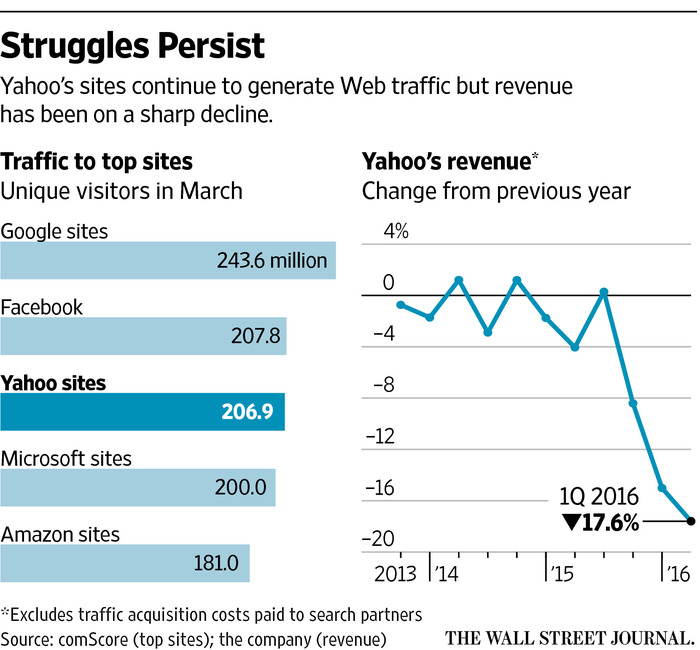

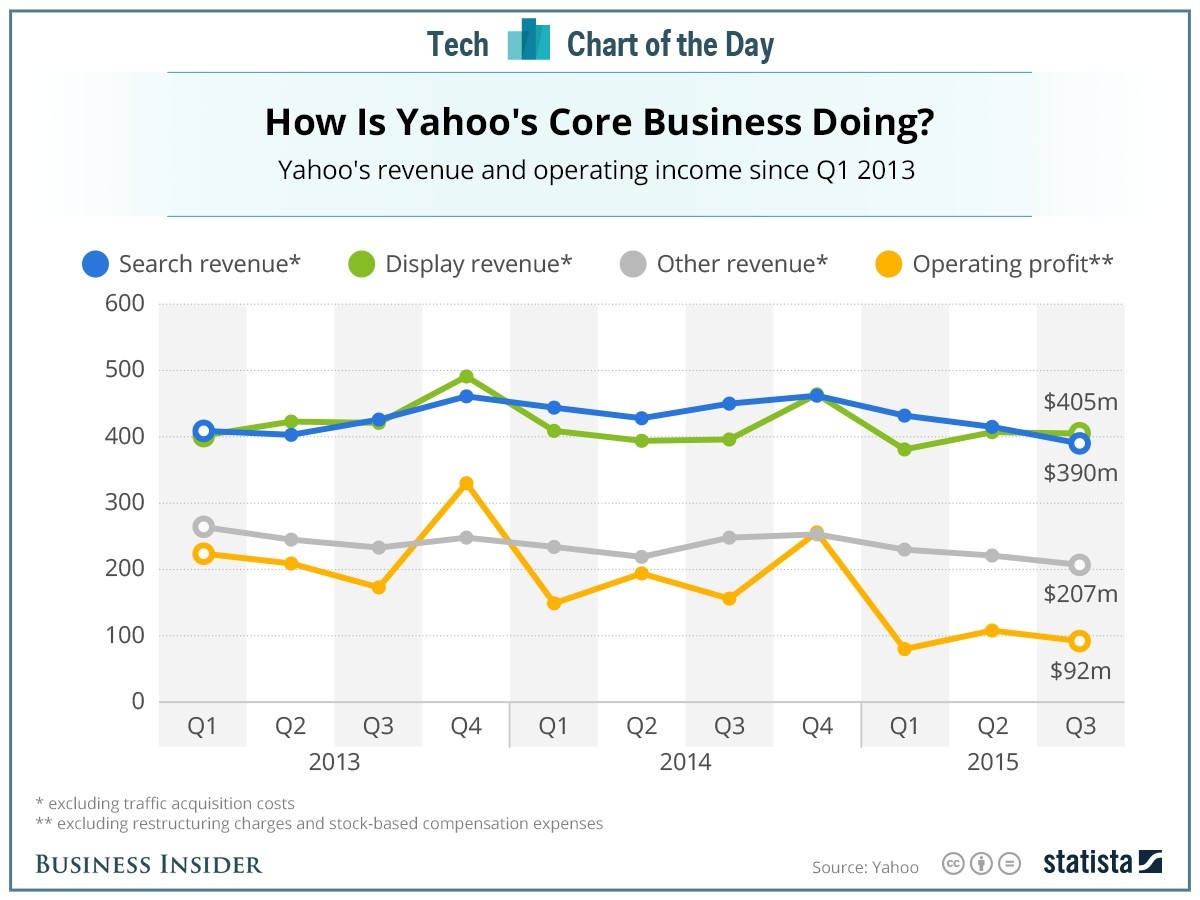

The company managed to beat Wall Street's limited expectations for revenue in the April-June quarter. But after subtracting commissions paid to its partners, Yahoo said its revenue fell 19 per cent from a year earlier, while its loss widened to $440 million.

Yahoo also reported Monday that it's writing down $482 million in charges related to the declining value of Tumblr, the social-blogging service that Yahoo acquired for $1.1 billion in 2013. Combined with an earlier write-down of $230 million, that indicates Tumblr's value has plunged by almost two-thirds.

Investors are waiting to hear about the company's plans, after Yahoo's board began soliciting bids from prospective buyers earlier this year. Monday was the deadline for final offers.

The list of prospective buyers includes two telecommunications providers, Verizon Communications and AT&T Inc., which are hoping to broaden their array of digital services. Also in the running is a group led by Quicken Loans founder Dan Gilbert with the backing of billionaire investor Warren Buffett. Several private equity firms that specialize in buying troubled companies are also believed to be in the running.

Investors have been betting a deal will get done, partly because Yahoo recently added a sale proponent, Jeffrey Smith, and three of his allies to its 11-member board. It's the main reason that Yahoo's stock has climbed 14 per cent so far this year, even as the company's fortunes have faltered. Yahoo shares rose 22 cents, or half of one percent, in after-hours trading Monday after closing at $37.95.

Analysts have estimated Yahoo will fetch $4 billion to $8 billion for a lineup that includes its email service and popular sections devoted to news, sports and finance. Most analysts expect the offers to come in the middle of the projected range.

Yahoo's recent financial performance is unlikely to drive the bidding upward. In the most telling sign of the company's deterioration, Yahoo's net revenue - after subtracting ad commissions - fell from slightly from more than $1 billion a year ago to $842 million in the latest quarter. That's the steepest decline yet under Mayer.

The company's loss of $440 million amounted to 46 cents a share, compared with a loss of $22 million, or 2 cents a share, a year ago.

After adjusting for one-time charges, Yahoo said it earned 9 cents a share in the latest quarter - short of the 10 cents that analysts surveyed by FactSet were expecting.

The eroding revenue comes as advertisers have been pouring more money into digital marketing as consumers spend more time living their lives online.

Most of the advertising, though, has been flowing to internet search leader Google and social networking leader Facebook Inc.

If Yahoo jettisons its struggling internet operations, it will still retain prized stakes in Yahoo Japan and Chinese e-commerce leader Alibaba Group. Yahoo's investment in Alibaba alone is currently worth $32 billion, before taxes.

Yahoo CEO announces mass staff cuts as revenue falls again

Yahoo said this week it would cut about 15 per cent of its 11,000 employee workforce and close offices in five cities as it swung to a massive fourth-quarter loss.

Shares of Yahoo fell 1.4 per cent in after-hours trading on Tuesday prompting the company to say it would simplify its product portfolio and that it had begun to explore divesting non-strategic assets.

Yahoo 7 hosts thewest.com.au, the online website for The West Australian, owned by Seven West, and redirects its email users to the news website after they log out.

Controversial CEO Marissa Mayer on Tuesday said it would simplify its product portfolio and had begun to explore divesting non-strategic assets.

"Yahoo is a far stronger, more modern company than the one I joined three years ago," Ms Mayer said.

"Today, we're announcing a strategic plan that we strongly believe will enable us to accelerate Yahoo's transformation.

"This is a strong plan calling for bold shifts in products and in resources.

"We are extremely proud of the billion dollar plus business we have built in mobile, video, native, and social. Products that are on the chopping block include Yahoo Games and Yahoo Smart TV.

On top of job losses, the company confirmed it would close five offices in Dubai, Mexico City, Buenos Aires, Madrid, and Milan.

"We plan to reduce our workforce by 15%," Mayer told investors on a video call.

Chief executive Marissa Mayer, who joined Yahoo in 2012 from Google, has been trying to revive the internet pioneer's core media and online advertising business by spending heavily to draw more users to its websites.

Mayer proposed in December that Yahoo spin off its main business, which includes its search engine, digital advertising units and its email service, after Yahoo abandoned efforts to sell its stake in Chinese e-commerce giant Alibaba Group Holding. But the company had provided few details.

Comments

There are 0 comments on this post