How to get yourself an awesome mortgage in 2017

"You wake up one day and you realise that all these years have gone by and I have this mortgage and I have this couch and I have this life and... is this going to be my prison?" said Lynn Shelton.

A while back bank mortgages were available to the borrowers with ease. You didn't have to do a tonne of paper works, get all things in perfect order to be able to get the home loan approved.

Nowadays, you need to prepare for the tiniest of the tiny thing that could probably affect your proposal. Therefore, sometimes you think it would be better to seek some professional expert advice.

Here comes the role of the mortgage consultants, most of the times its the real estate agent themselves.

And it's premium service that only a few of the borrowers could afford it.

You may, in that case, consider doing all the grit work yourself. That may not seems to be wise if you are good with paperwork or hefty calculations and making assumptions.

Which mind you, you will have to do a lot.

Like now the banks don't use the salary multiple to ascertain how much should they lend you. They now use affordability calculations. What does this mean?

Well, it simply weighs your essential spendings, alongside your income. Lenders would look at the gap between what you spend and you make. So, be prepared to be quizzed on habitual spending.

Here, are a few things that you could do to make yourself a more attractive proposition to a lender.

Make sure you are on the electoral roll and everything matches with your mortgage documents.

Then check your credit file with the major credit agencies Equifax, TransUnion and Credit Bureau. Challenge anything that is wrong.

Take out a credit card, spend some money and then pay it back. Lenders like people with a record of borrowing money and paying it back in time.

It is also recommended that you do not switch jobs and rental properties. Why? Stability is the word here.

Now, if you need to get a loan. You need to know exactly how much you need to borrow.

What's the worth of your house or property?

What percentage of the value is the mortgage?

This is used to determine the loan to value. E.g. - Your house is worth $50,000 and you took a mortgage of $30,000. Then the percentage of loan to value is 60%.

Lower the percentage the better rates you get. And note, don't forget the processing charges as they tend to be high around $2,500.

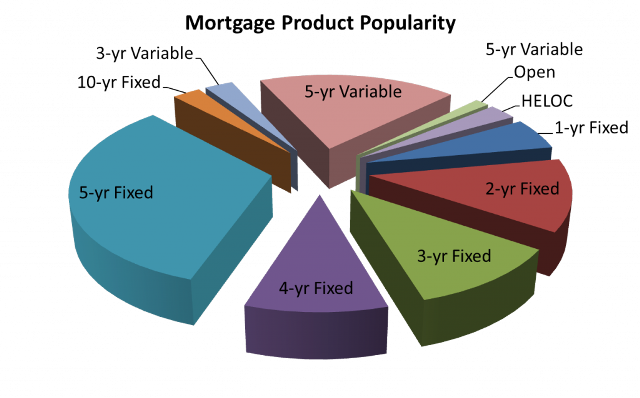

You are now ready to take your pick.

Comments

There are 0 comments on this post