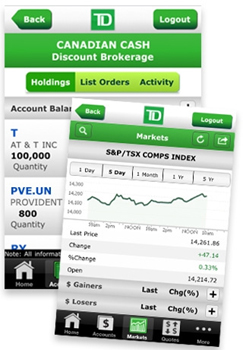

TD Canada Trust: Canadians embrace mobile banking

(NC) — Whether they're on a bus or in a coffee shop, more and more Canadians are embracing banking on the go, by shifting their everyday financial habits from the online world to their mobile phones.

“Canadians have flocked to our TD mobile app, making it the most downloaded banking app in the country,” says Joan Dal Bianco, Vice President, Online Channel, TD Bank Group. “Now over one million customers have downloaded it so that they can check account balances, pay bills or make transfers. Their phone is a core part of their banking experience and they've come to depend on it as much as an ATM or branch.”

More benefits of mobile banking include:

• Bank anywhere, anytime—From making bill payments to checking the stock market, mobile banking lets people bank from almost anywhere in the world.

• Instant access to up-to-date information—You have 24/7 access to your account information at the tips of your fingers. This means there is no waiting to check account balances or find the closest ATM.

• Avoid missed bill payments—Receiving bills electronically can be easier to keep track of than paper statements, as they don't slip off your radar. Mobile banking makes it even easier to pay bills, or send, receive, view or cancel Interac email money transfers from wherever you are.

• Security—Mobile banking is a secure way to check your account history and make transactions. Having instant access also means you can regularly monitor your account to verify transactions and keep an eye out for unusual activity.

• Greener banking—Eliminating paper statements, bills and cheques will help reduce your carbon footprint.

Comments

There are 0 comments on this post