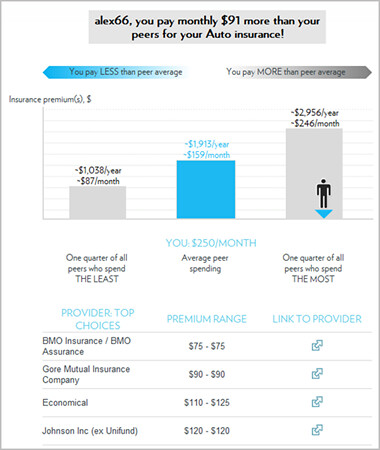

Canadians Pay on Average $120 Monthly on Auto Insurance

Do I pay too much for my insurance? Until now, there hasn’t been an easy answer. Consumers might speak with friends and family, or check individual offerings from an insurance provider. What most Canadians don’t realize is that insurance quotes can vary by more than 200% for the same product, because different insurers focus on different customer segments. Very often we ask our friends, family, and other people we trust what they pay and which insurers they prefer. But the best way to get a fair comparison would be to find everyone with a similar profile in terms of age, location, income and other details. However, finding these people and asking them what they pay and with which provider might not seem easy. A young Canadian company, InsurEye, has found a way to make this solution a reality with its new free Peer Comparison tool. It’s social aggregated knowledge at work to save you money on insurance. InsurEye Inc. [http://www.insureye.com] is an independent Canadian company offering innovative online tools to help consumers understand and manage their insurance. Using the Canadians pay on average $120 monthly for Auto insurance and $74 for Home insurance. You live in Ontario? The average monthly auto insurance rate there goes up to $148. Want to consider your age, gender, and income? No problem. Want to see which companies offer good deals to your peers? It’s all included on the interactive chart. Now insurance shoppers can be informed and prepared when switching insurance policies. InsurEye web site: InsurEye Peer Comparison service: Email:

InsurEye Peer Comparison service collects, validates, and precisely analyzes thousands of insurance experiences from real people. Peer Comparison includes spending information for insurance products available online (small share of the total market) and services offered directly by insurance companies, brokers and agents. As users share information about their insurance spending, this collective experience identifies the peer groups who save the most. Using the simple and user-friendly interface, users can learn which companies to choose in order to save on insurance.

Comments

There are 0 comments on this post